End to End trade life cycle – Our trading APIs help you authenticate, get market feed, place order, get order/trade response, get margin, holdings & positions, get content, facilitate payments & more

Cloud REST APIs with standard documentation & Help files making them easily consumable. Multiple Language supported.

Socket based APIs for handling ultra-low-latency streaming broadcast (Market feed) and order response data

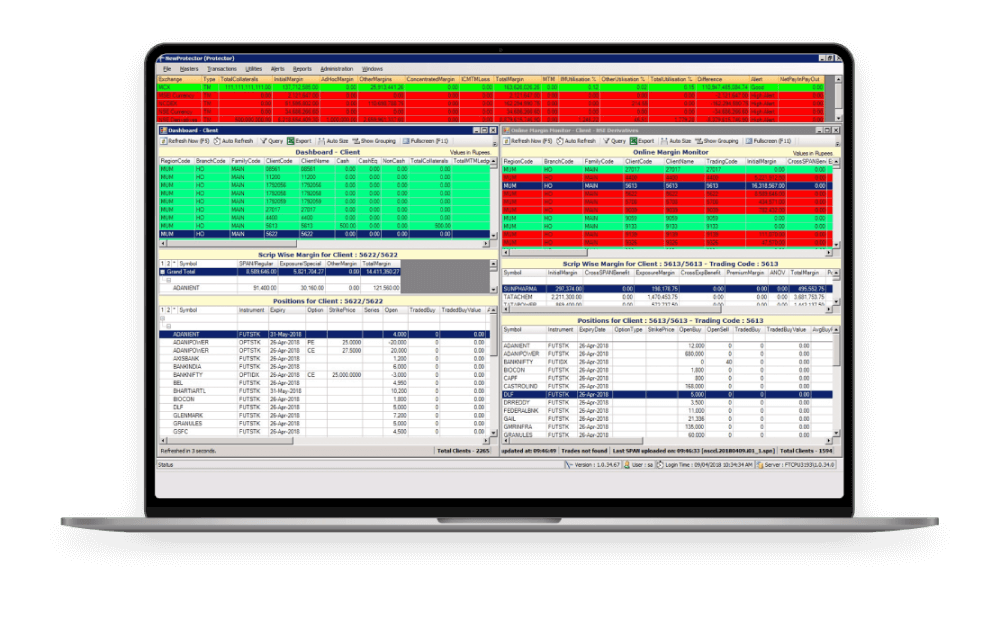

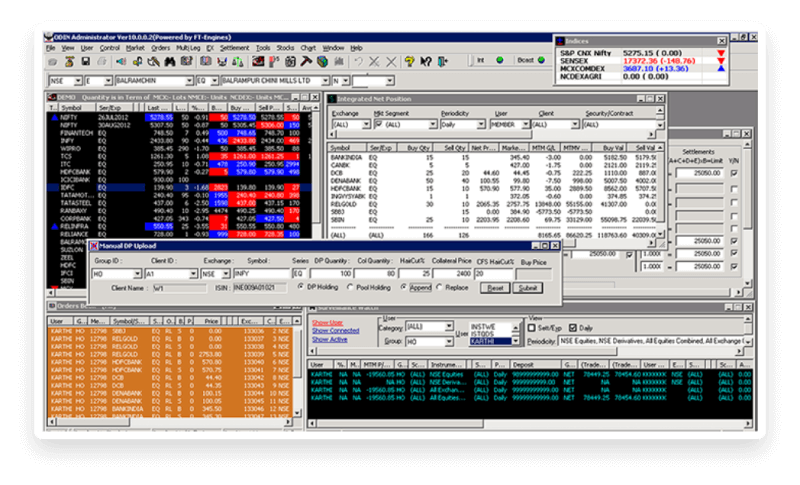

Backed by class leading, proven Order & Risk Management systems, capable of managing any scale at very high throughputs

Supports all segments & order types including complex orders like Stop Loss, Bracket, Good Till Date(GTD), Margin Trading Facility (MTF) etc

App development services to help you create your unique trading app experiences

App SDKs available for integrating Broking functionalities into investment super-apps.

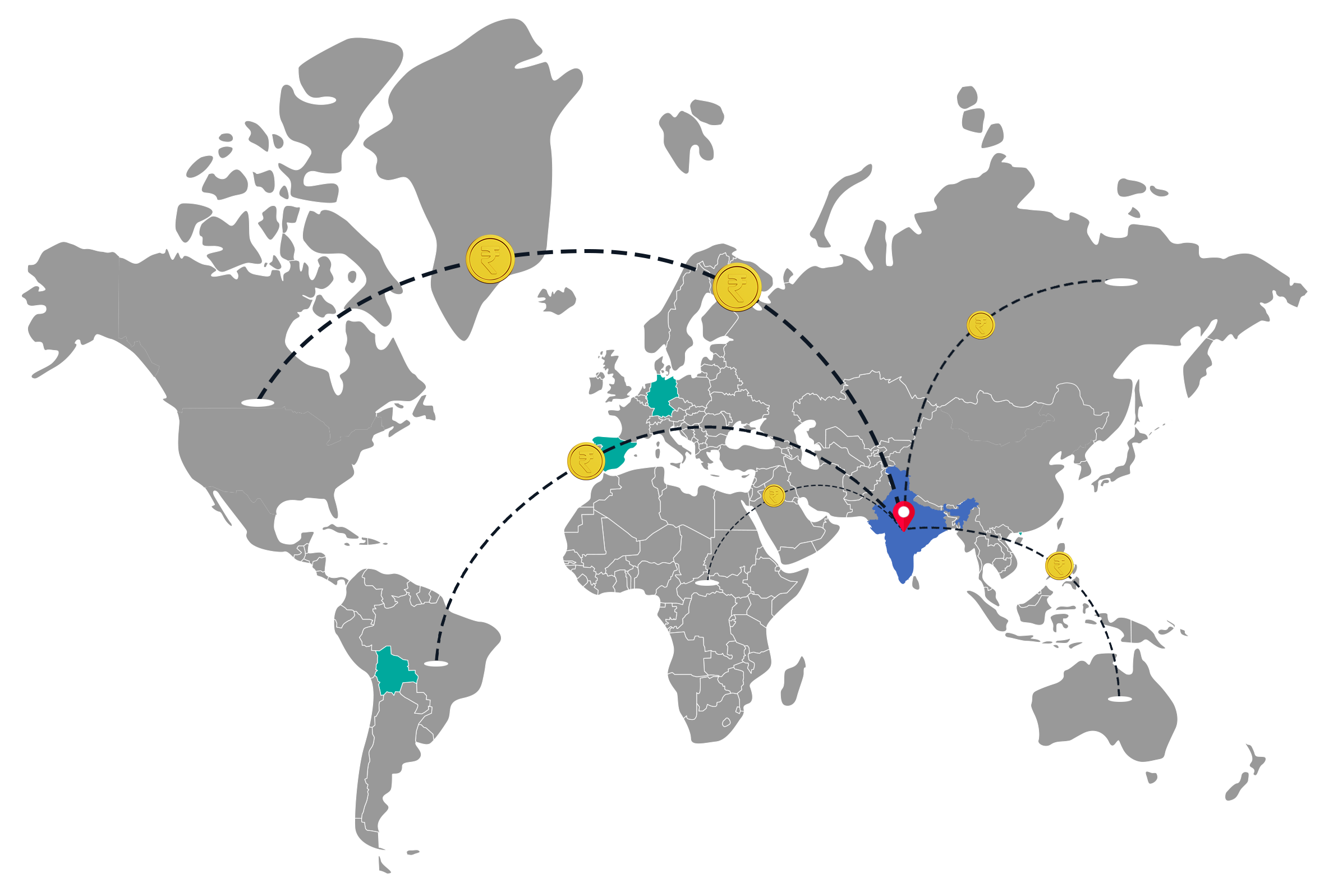

Rich ecosystem: Content, PG integration, User Management, Analytics & Onboarding APIs. Fintech players associated with us