Post trade risk management and transaction settlement products

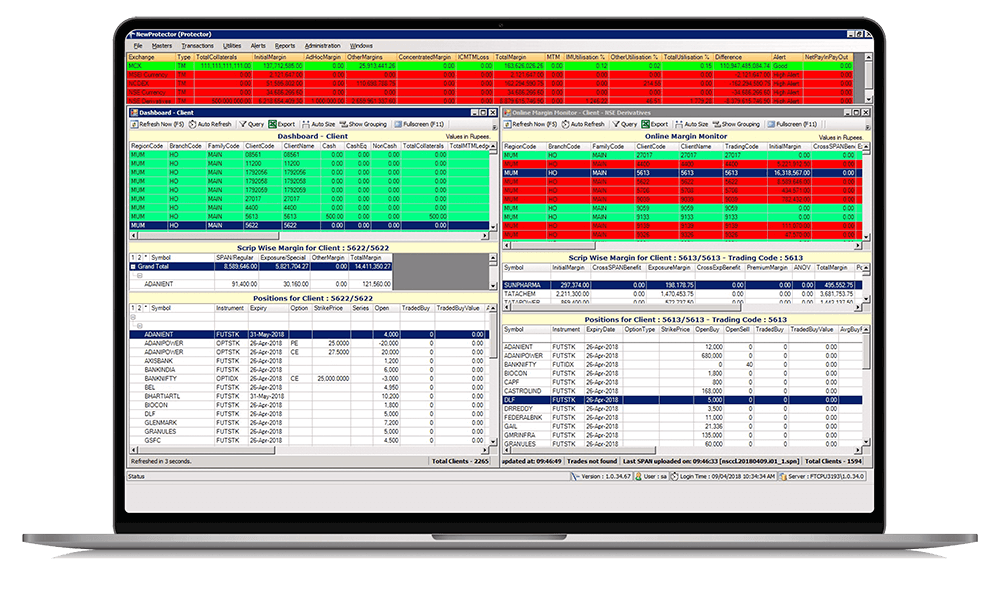

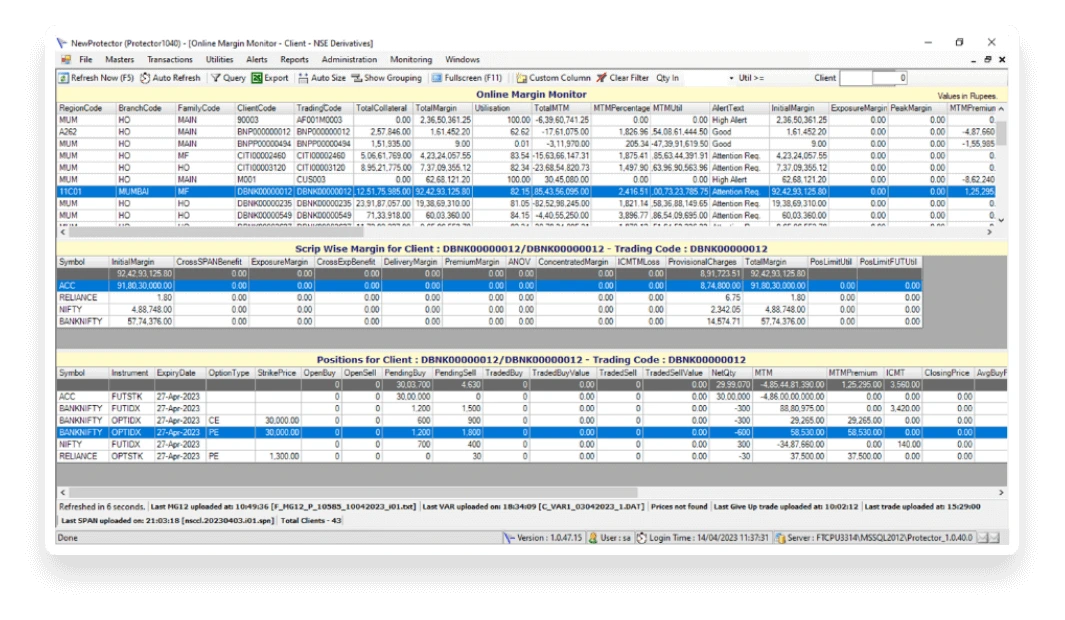

Online enterprise level post-trade risk management solution

Exchange Trades (Give-up Trade)

Trades Reconciliation (Client Reported Trades)

RMS Computation

SPAN Margin

Exchange Add-on

Position Limit

Trading in BAN Scrip

RMS Zone Definition and Check

Broker Margin Ticker

Trades Acceptance / Export to Exchange (Auto/Manual)

Alert Popup / SMS / Email

Margin calculator

Trade dump / Peak position

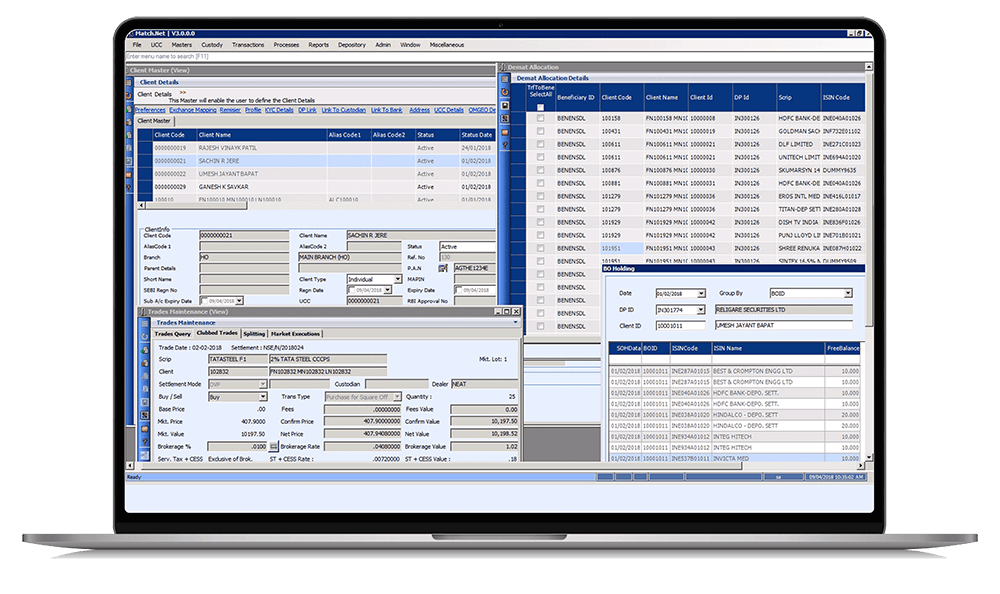

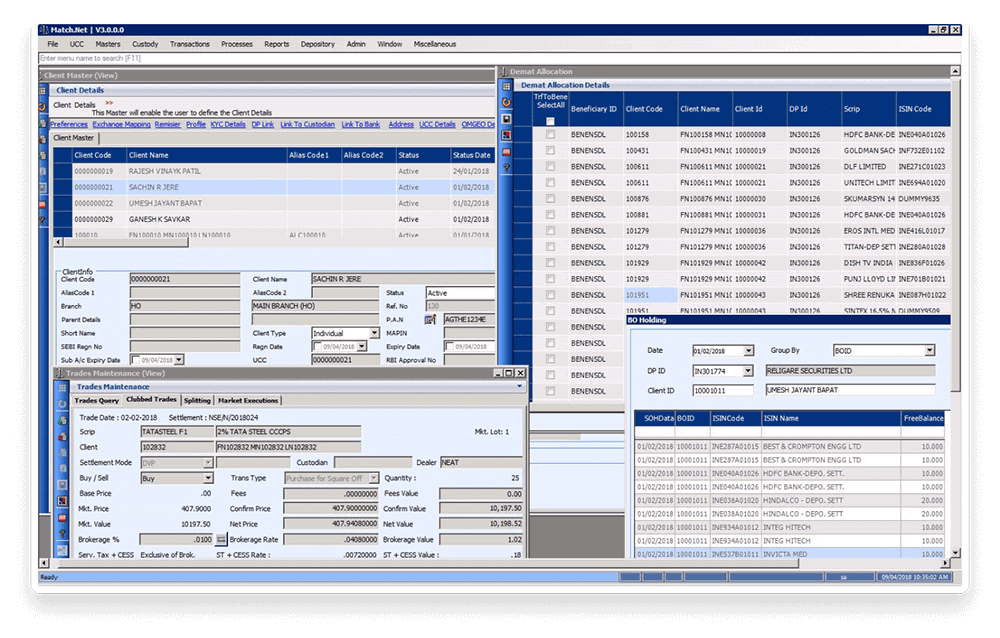

Comprehensive suite of back office solutions, seamlessly fulfilling end to end post-trade requirements

Flexible brokerage rates and multiple brokerage schemes

Facility of creating various tariffs(for regulatory levies) i.e. Service Tax, CESS, STT, Turnover Charges, Transactions Charges, etc.

Multi-level grouping

Client’s Trade & Settlement related preferences captured at Exchange Level

Links to multiple banks

Multiple DP – Client ID

Maintenance of KYC related info

Links to multiple custodians

Multi-level grouping

Smooth Integration with multiple trading front ends

Seamless integration with bank, depositories and custodians

Handling share transfer & custodial handling

Integration with Omgeo

Event-based financial accounting & configurable chart of accounts

Various statements such as Balance Sheet, Profit-Loss Account, Trial-Balance, etc.

Reports such as Day Books, General Ledger, Sub-Ledger available on-line

Collateral Module is available for maintaining details of collaterals submitted by the client and given to the exchange

Provision for daily collateral revaluation

Provision for Haircuts at various levels

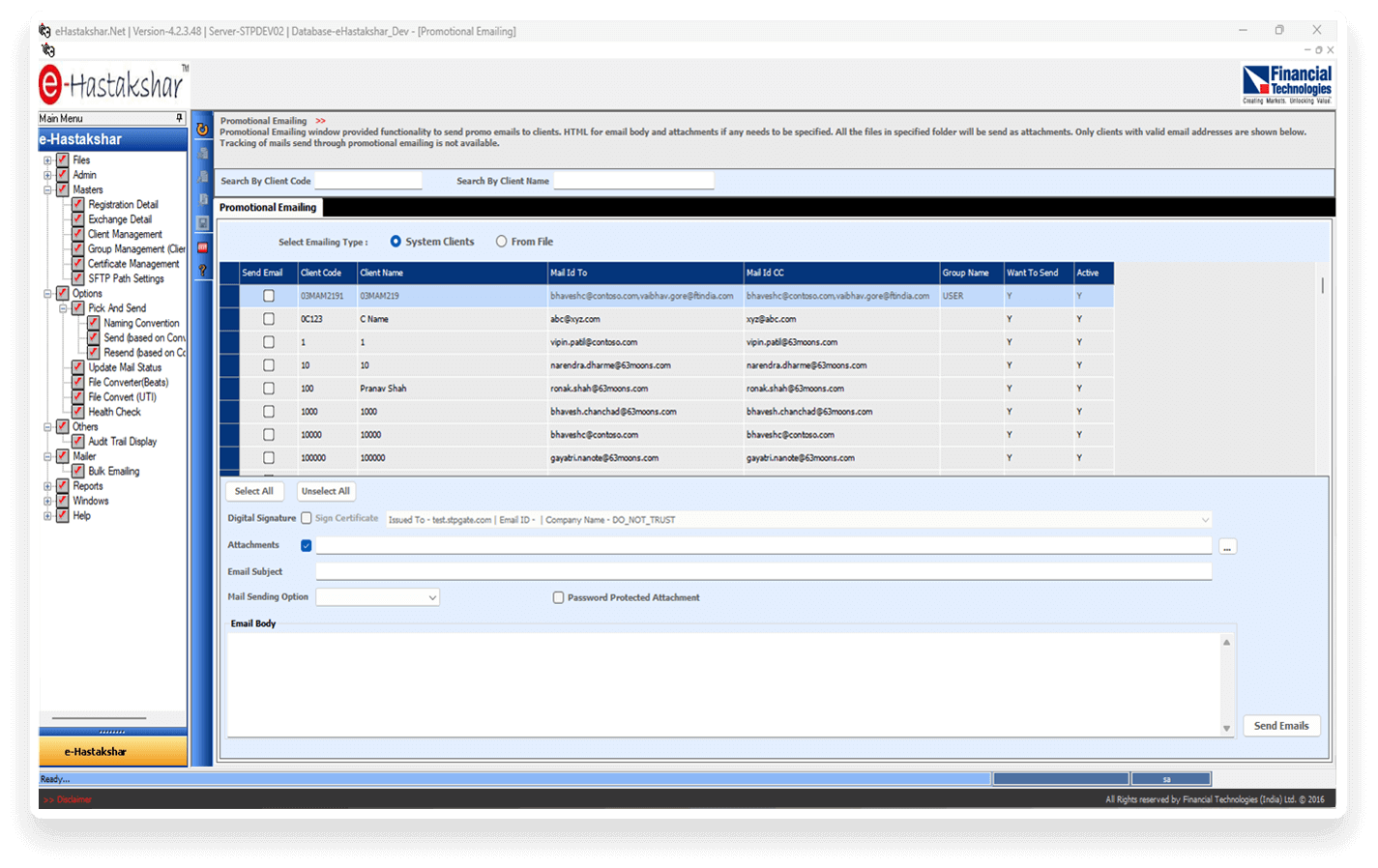

Mailing Module facilitates automatic dispatch of selected reports such as Contracts, Bills, Ledger etc. to subscribing clients through Email or FAX.

Multiple reports compressed into a single zip file optimises outgoing mail sizes

Compliant with all exchange regulations

Custom report builder tool facilitating ad-hoc reporting requirements

Comprehensive log of mailing activities

Maintains Confidentiality, ensures Authentication

Multi-User, Multi-session, capability ensures non-repudiation

Ability to define access control at a Group or User level

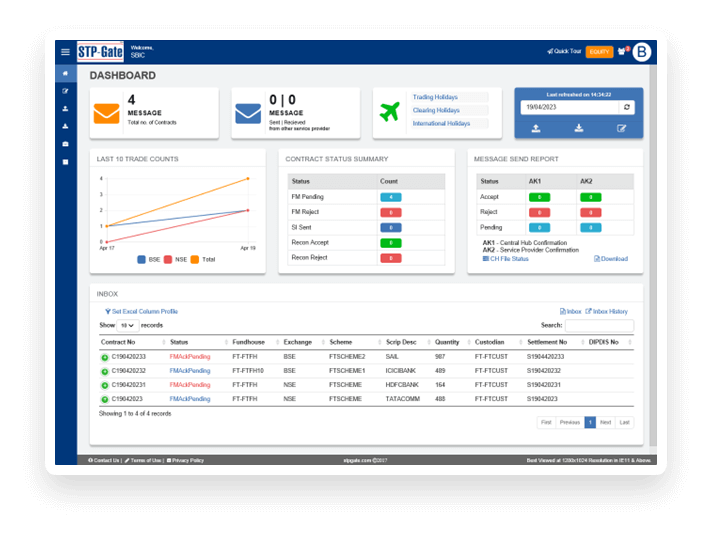

Automates trade lifecycle events across multiple (Equity & Derivative) asset classes

Electronic trade confirmation

Drastically lowers risk and cost of failed trade confirmation

Common Platform for transaction settlement for Investment Managers, Broker, Dealers and Custodian

Same-day trade confirmation

Increased efficiency and decreased operational risk and costs as the post trade life cycle is standardized

It follows a standard process flow based on ISO 15022 standard File format along with digital signature

95% of the Indian Market participants are connected to STP-Gate platform

Plug and play solution for Investment managers- Switching ON the STP-Gate solution at Investment Manager end gives them instant access to standardized pre-set formats & integration with 95% of the Indian equity market participants

Real-time communication of trade & Settlement confirmations, and affirmations

Real-time Status update

Eliminates errors that exist in manual and verbal communications

Standardize file format and process

The flow of data and file format is standardized

Eliminates delays that can lead to increased risk of failed trades and higher costs

Centralizes data

Minimizes back-office costs & duplication of efforts

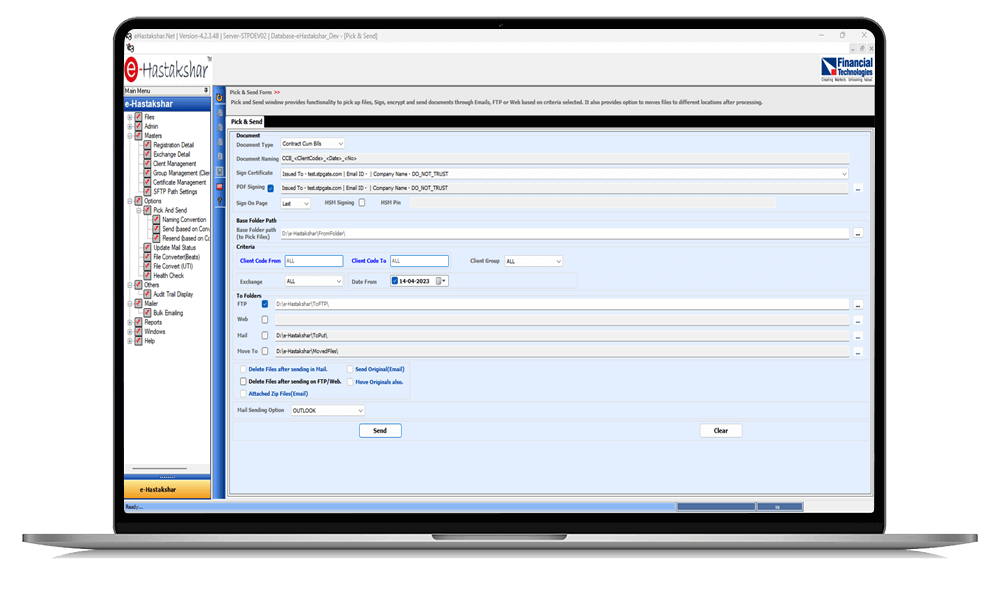

Online document signing solution

Digitally signed Contract Notes for fulfilling compliance requirements

Ensuring online availability of contract notes and seeking digital acknowledgment of contract notes from clients within stipulated time period

Depository Participants can automate sending of documents such as statement of transactions, statement of holding and other related documents to the end clients by sending secure digitally signed statements.

Multi-user administrator

Scheduler and report builder

Inherently ensures non-repudiation

Web enabled (post-delivery on portal)

Legally binding Multi-login operation capability

Capability to interface with varied back office applications

Multi-channel document delivery support – e-mail, web portal or FTP

MIS reports provide statistics of imported/signed/dispatched/

delivered documents